Introduction

It’s widely known that The Philippines has one of the fastest-growing economies in Southeast Asia. As businesses in the financial industry strive to capture this market, search engine optimization (SEO) and search engine marketing (SEM) campaigns have become crucial tools for success. In a digital landscape where competition is fierce, these strategies are essential for financial institutions looking to stand out from the crowd and attract potential customers.

In this blog post, we will explore how SEO and SEM campaigns can be utilized effectively within the financial industry in the Philippines, providing insights and tips on maximizing their impact. So if you’re ready to unlock new opportunities and boost your online presence in this thriving market, keep reading!

Introduction

Definition of SEO and SEM campaigns for the finance companies

In the context of digital marketing for the financial industry, SEO refers to the strategies and techniques used to optimize a website’s visibility and rankings on search engine result pages (SERPs). By employing relevant keywords, creating high-quality content, and enhancing website structure, SEO ensures that the financial website appears prominently when potential clients search for appropriate services.

On the other hand, SEM involves using paid advertisements, such as Google Ads, to increase a website’s visibility in search engine results. By bidding on specific keywords, financial institutions can display their ads prominently, capturing the attention of individuals actively searching for financial services.

SEO and SEM campaigns are essential components of any successful digital marketing strategy for the modern financial industry. These approaches ensure that potential clients easily find and engage with the website, leading to greater brand visibility, increased traffic, and, ultimately, more conversions for the company.

Introduction

Importance of SEO and SEM strategies for financial sector

Whether you are a banking institution, an insurance company, or an investment firm, a well-crafted SEO and SEM campaign is the key to attracting potential customers and building trust in the digital landscape.

Implementing robust SEO techniques ensures the website ranks highly on search engine results pages (SERPs). We can utilize targeted keywords and optimize the website’s structure and content to take advantage of the algorithms that determine search rankings.

For instance, incorporating localized keywords such as “business loan in [city name]” or “independent financial advisor near me” can greatly improve your chances of appearing in relevant local searches. This approach boosts online visibility and attracts customers in the specific target market.

Additionally, SEM campaigns, including pay-per-click advertising (PPC), are essential to enhancing the online presence. With PPC ads, the brand is placed at the forefront of search results, increasing the likelihood of capturing the attention of potential customers. Creating high-quality landing pages that address the target audience’s specific needs and pain points can significantly increase conversion rates and attract customers who are genuinely interested in financial services.

Furthermore, when designing SEO and SEM campaigns, it is vital to understand the dynamic nature of the financial industry. That means staying updated with the latest trends, regulations, and keywords relevant to the Filipino market. That includes developing a content marketing strategy encompassing articles, blog posts, infographics, and videos that educate and engage your audience. It will deliver value through knowledgeable and reliable information that establishes your organization as an authority within the company’s client base. By employing these strategies, your organization can rise above the competition and connect with potential customers at every stage of their buyer’s journey.

Understanding the Financial Industry in the Philippines

Brief overview of the financial industry landscape in the Philippines

Let’s recognize the major players in the Philippine financial sector. These include commercial banks, investment banks, insurance companies, and financial intermediaries.

- Commercial banks form the backbone of the industry, providing a wide array of services such as savings and current accounts, loans, and credit facilities to individuals and businesses.

- Investment banks, on the other hand, specialize in facilitating capital market transactions, including underwriting securities, mergers and acquisitions, and investment advisory services.

- Insurance companies provide protection and risk management services to customers, offering policies covering life, health, property, and other forms of insurance.

- Microfinance institutions and pawnshops have also gained popularity, catering to individuals and small businesses needing access to traditional banking services.

One notable trend in the financial industry is the rise of digital banking and fintech solutions. With the advent of technology, both local and international banking institutions have embraced online banking, mobile payments, and other innovative financial services. This digital revolution has increased access to banking services for Filipinos and shaped how financial transactions are conducted in the country. (source: mckinsey)

Regulatory oversight is another crucial aspect of the financial landscape in the Philippines. The Bangko Sentral ng Pilipinas (BSP) is the central regulatory authority responsible for the stability and integrity of the financial system. It sets policies, regulations, and guidelines to ensure the soundness and transparency of financial institutions.

Additionally, the Securities and Exchange Commission (SEC) regulates capital markets, while the Insurance Commission oversees insurance companies operating in the country. Understanding the financial industry in the Philippines is only complete when it acknowledges consumers’ changing needs and preferences.

Filipinos are becoming more financially literate and demanding regarding financial services. This shift in mentality has led to a greater emphasis on financial education. Programs started by the Department of Education, or Bangko Sentral ng Pilipinas, empower individuals to make informed financial decisions and build an educated client base for financial institutions.

Understanding the Financial Industry

Key players on the market

Let’s start with the banks – the backbone of the financial sector. From the well-established giants to the smaller regional institutions, Philippine banks offer a wide range of services such as corporate and retail banking, loans, savings and deposits, and digital transactions. These local and international banks take pride in their commitment to financial stability and their ability to contribute to the country’s economic growth.

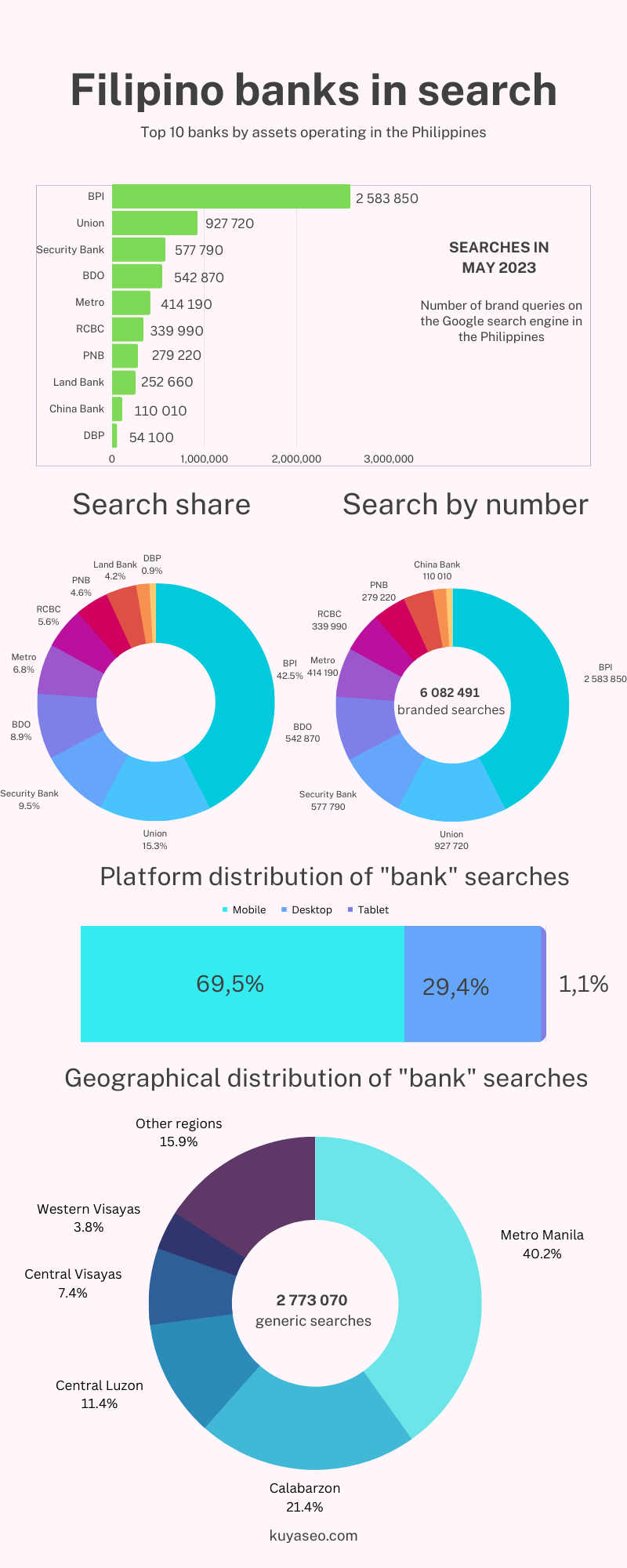

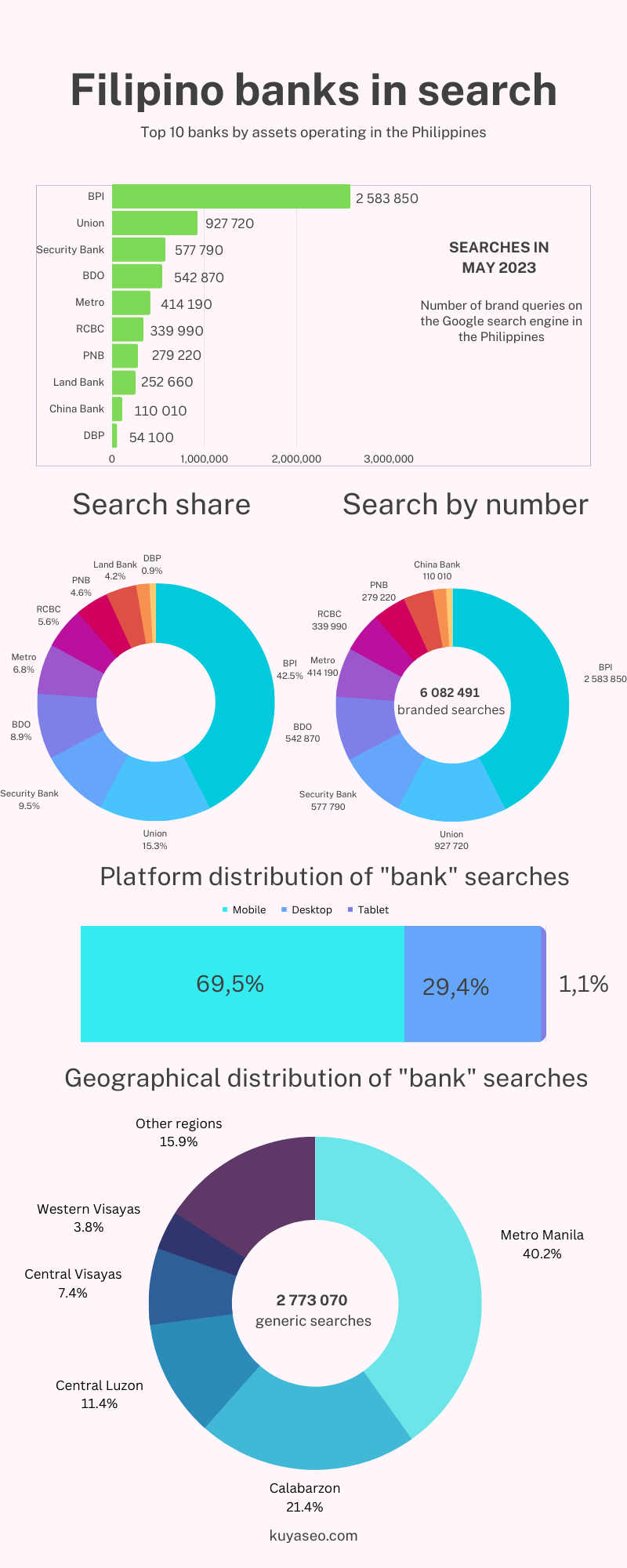

Here, we come up with an infographic that shows the most searched banks in the Philippines.

Moving on to insurance companies, they play a pivotal role in protecting individuals, businesses, and assets alike. Whether life, health, property, or vehicle insurance, these companies provide their policyholders security and peace of mind. With a multitude of options available, Filipinos can choose insurance plans tailored to their needs and preferences.

Investment firms, the third pillar of the financial industry, offer opportunities for individuals and businesses to grow their wealth. From traditional investment vehicles like stocks and bonds to more advanced options like mutual funds and real estate investment trusts (REITs), these firms help clients diversify their portfolios and maximize returns.

As the Philippines continues to experience rapid growth, technology and innovation have become cornerstones of the financial industry. Fintech startups are reshaping the sector by providing alternative lending solutions (Cashalo), peer-to-peer payment platforms (Gcash), and mobile banking apps (Maya) that cater to the digital-savvy generation. This seamless fusion of finance and technology empowers Filipinos with easier access to financial services and enables them to make more informed decisions about their money.

Understanding the Financial Industry in the Philippines

Growing importance of digital marketing for financial institutions

As consumers become more tech-savvy, financial institutions must adapt to these changing trends to stay relevant and meet customer expectations. One of the most significant advancements in recent years is the growing importance of digital marketing.

Digital marketing has become an indispensable tool for financial institutions as they navigate the intricacies of the Philippine market. With digitalization penetrating all aspects of daily life, financial institutions have recognized the need to establish a robust online presence to reach their target audience effectively. Gone are the days when people would visit a brick-and-mortar bank to inquire about financial services.

Nowadays, customers expect instant access to information and seamless transactions, all at the click of a button. Financial institutions can expand their customer base and enhance brand awareness through digital marketing strategies such as search engine optimization (SEO), pay-per-click campaigns (PPC), and content creation. By attentively analyzing data and consumer behavior, companies can tailor their marketing efforts to cater specifically to the needs and preferences of their target audience.

One of the key advantages of digital marketing is its ability to provide a personalized and engaging experience for customers. Financial institutions can effectively communicate their unique value proposition through targeted advertisements and relevant content to potential clients. Whether offering competitive interest rates, innovative financial products, or exceptional customer service, digital marketing allows financial institutions to showcase their strengths and establish long-lasting customer relationships.

Moreover, digital marketing enables financial institutions in the Philippines to overcome geographical limitations and tap into previously untapped markets. With the vast reach of the internet, institutions can extend their services beyond their physical locations, attracting customers from all corners of the archipelago. This expansion increases market share and stimulates economic growth by providing individuals and businesses with financial resources and opportunities.

The Role of SEO Campaigns for Financial Institutions

Keyword research and optimization

Among various crucial components of a successful SEO campaign, keyword research and optimization take center stage. These serve as the building blocks that lay the foundation for a robust online presence and better search engine rankings for financial institutions.

Keyword research involves an analysis of keywords and phrases that potential customers may use while looking for financial services. It aims to identify the industry’s most relevant and highly-searched terms, ensuring that a website appears as a top result when users input those keywords. This research should involve utilizing third party tools, examining competitors’ strategies, and gaining insights from market trends.

Financial institutions can tailor their content and website structure by understanding user behavior and intent to align with customers’ needs, reinforcing the chances of appearing on the first page of search engine results.

Once the keywords are identified, optimization comes into play. This phase involves incorporating the chosen keywords throughout the website content and technical aspects. By seamlessly integrating these targeted terms into titles, headers, meta descriptions, and the overall content, search engines gain a clearer understanding of a website’s relevance to users’ search queries. Consequently, this enhances the chances of the website ranking higher in search engine result pages (SERPs) and attracting more organic traffic.

However, financial institutions need to strike a balance between optimization and maintaining a natural, engaging tone. Gone are the days of keyword stuffing and subpar content; modern-day SEO demands high-quality, informative, and valuable content that addresses customers’ queries and concerns. By creating articles and guides centered around the chosen keywords, financial institutions can attract potential customers and build credibility and authority in the industry.

Furthermore, the role of SEO campaigns in the financial sector goes beyond mere keyword research and optimization. It extends to local search visibility, mobile optimization, and online reputation management. By incorporating location-specific keywords, financial institutions can improve their visibility for local customers, ensuring their branches and services are easily discoverable for those in need. Likewise, with the increasing dominance of mobile devices, optimizing websites for mobile-friendly experiences becomes crucial to capture the attention of on-the-go users.

Importance of keyword research

Keyword research involves identifying and understanding the search terms that potential customers employ while seeking financial services. It allows companies to tailor their content and offerings to suit their preferences effectively. It is the compass guiding financial institutions toward the exact words and phrases that mirror their target audience’s intentions, desires, and needs.

This optimization ensures that when a user types in a relevant search query, the financial institution’s website is more likely to rank higher in search engine results, boosting its visibility and attracting organic traffic.

Moreover, keyword research allows institutions to understand the landscape by uncovering the search terms utilized by rival companies, thereby identifying potential gaps or opportunities. With this knowledge, financial institutions can refine their content strategy and create highly tailored offerings, giving them a competitive edge online.

It is worth noting that keyword research is not a one-time endeavor but requires constant monitoring and adaptation to stay relevant in an ever-evolving digital landscape. Therefore, financial institutions must make it an ongoing part of their SEO campaigns to enjoy sustainable success.

Website content optimization

Before diving into the nitty-gritty of content optimization, financial institutions need to grasp the essence of their target audience and the specific services they offer. Understanding potential clients’ core needs, pain points, and preferences is the bedrock of a successful SEO campaign.

With this knowledge in hand, extensive keyword research comes into play. Once the target keywords are identified, the optimization process begins. Financial institutions must strategically incorporate these keywords into their website’s content, placing them in the headlines, meta descriptions, and body text. This helps search engines understand the focus of the page but also improves the overall user experience.

Intelligently infusing keywords into the content and maintaining a natural flow is essential for balancing visibility and user engagement. Moreover, financial institutions must remain consistent in their keyword optimization efforts.

As search engine algorithms evolve, staying up-to-date with the latest trends and preferences is imperative to maintain and improve organic search rankings. Regularly reviewing and updating keyword strategies is vital to ensure the website remains relevant and visible to the target audience.

The Role of SEO Campaigns for Financial Institutions

On-page optimization techniques

An effective SEO strategy entails more than just keywords and content; it encompasses on-page optimization techniques that greatly influence website visibility and user experience.

One aspect to consider is the website’s loading speed. A slow-loading website can deter potential clients, impacting the user experience and causing them to abandon the site. Implementing strategies such as image optimization, forcing HTTPS protocol, and leveraging browser caching can significantly enhance website loading speed, ensuring a seamless experience for visitors.

Moreover, optimizing meta tags, including title tags and meta descriptions, improves search engine visibility and attracts relevant traffic. These meta tags act as concise summaries of your web pages, providing search engines and users with essential information about your content. By crafting unique, compelling, financial institutions may rank higher on search engines, driving increased organic traffic to their websites.

Another on-page optimization technique that must be considered is the effective use of header tags. These HTML tags, ranging from H1 to H6, allow search engines to understand the structure and hierarchy of your content. By using relevant keywords in your header tags, you can better communicate to search engines and users what your content is about, boosting your website’s visibility and improving the overall user experience. Among others, these strategies can enhance user experience and increase website visibility, ultimately reaching their intended audience more effectively in the online landscape.

The Role of SEO Campaigns for Financial Institutions

Content marketing strategy to achieve business goals

Content creation is a rock-solid strategy at the heart of every effective SEO campaign. It allows banks, insurance, and trading companies to demonstrate their expertise and build trust with their audience. Producing high-quality, relevant, and insightful content establishes the institution as a valuable resource within the industry.

Blog posts, articles, and whitepapers can showcase industry trends, expert analysis, and advice on financial matters, capturing the attention of potential customers seeking reliable information. By consistently delivering valuable content that addresses the pain points of their target audience, financial institutions can position themselves as authoritative figures, leading to increased brand recognition and loyalty. From discussing the benefits of diversification to sharing expert insights on investment opportunities, every piece of content should be curated to provide immense value to the readers.

Moreover, the content marketing strategy should aim to establish a connection with the target audience on a deeper level. By incorporating relatable anecdotes, real-life examples, or success stories, financial institutions can humanize their brand and make the readers feel understood.

Aligning an SEO campaign with specific short and long-term goals can significantly enhance the efficiency of the efforts. In the short term, financial institutions should aim to boost website traffic, increase brand visibility, and foster engagement through captivating content. Leveraging appropriate long-tail keywords and optimizing website structure to enhance user experience lays the groundwork for sustainable growth.

Over time, the focus shifts towards establishing industry expertise, attracting high-quality backlinks, and bolstering organic search rankings to secure a competitive edge in the financial landscape. Metrics such as organic traffic growth, click-through rates, conversion rates, and average time spent on the website provide valuable insights into the effectiveness of the content marketing strategy.

By tracking these KPIs, financial institutions can continuously refine their SEO campaigns, optimize their content, and adapt to ever-changing search engine algorithms.

SEM Campaigns for Financial Institutions

Pay-per-click search advertising

One of the major advantages of PPC campaigns for financial institutions is their cost-effectiveness. Unlike traditional marketing channels, PPC enables institutions to set a predetermined budget and pay only when users click on their ads. This ensures that their marketing budget is utilized efficiently, with every Peso spent on potential customers who have demonstrated an active interest in their services.

It empowers financial institutions to accurately measure their return on investment (ROI), fine-tune strategies, and optimize ad campaigns to achieve desired profitability. Furthermore, PPC gives complete control over advertising campaigns. An SEM agency can customize ad content, call-to-actions, and selection of specific demographics and locations to target the desired audience.

Conversion tracking is another key feature that makes PPC a vital component of SEM campaigns for financial institutions. By integrating conversion tracking with campaigns, marketers can precisely measure and evaluate the impact of their ads on user behavior. Metrics such as click-through rates, conversion rates, and cost per acquisition provide actionable insights to optimize future campaigns. These metrics help to identify the most profitable keywords, refine ad copy, and modify landing pages to enhance user experience and increase conversions.

An agency can continually improve PPC campaigns and achieve optimal results by data-driven decisions. We can track the number of leads generated, sign-ups completed, or transactions made on the website, providing insights into the effectiveness of the marketing strategy.

SEM Campaigns for Financial Institutions

Principles of efficient search engine ad copies

A successful SEM campaign, at its core, revolves around creating captivating ad copies that entice users to click and engage with the landing page. Crafting compelling copy starts with understanding your target audience’s intents. Delve into their desires, aspirations, and pain points. Are they looking to apply for a loan, open a savings account, or gain financial advice?

By understanding their motivations, we tailor ad copies with persuasive language, ensuring they resonate with the audience on a personal level. However, efficient ad copies go beyond simply appealing to emotions. A keyword analysis that potential customers will likely use when searching for financial products or services is fundamental. By integrating these keywords into ad copies, we can impact a Quality Score metric and enhance the chances of appearing at the top of search engine results or lower costs per click.

Another must-have step is utilizing ad extensions to expand the visibility and effectiveness of the ads. Extensions such as site links, callouts, and structured snippets allow the display of additional information about financial products and occupy more space over organic search results.

Additionally, adding audience lists to search campaigns can yield positive KPI results. By observing user data collected through previous interactions with the website or app, we can adjust bids and analyze potential customers who have previously browsed the offerings. Tweaking ad copies and modifying them to mirror specific audience segments allows for elevating ads’ relevancy and improving CTR.

SEM Campaigns for Financial Institutions

Display Advertising

Display advertising plays a supportive role in the success of SEM campaigns for financial institutions. Display ads capture attention and engage the audience with a visually enticing format, driving brand awareness and building reach. As netizens navigate the online sphere, eye-catching display ads allow financial institutions to amplify their presence and cost-effectively reach a broad audience. These ads convey key messaging, showcasing the unique value propositions of the institution’s diverse products and services.

Moreover, display ads allow advertisers to target the desired audience precisely, ensuring the message reaches the right people at the right time. By leveraging data-driven insights and user demographics, institutions can tailor their display ads to be contextually relevant, resonating with individuals more likely to be interested in their offerings. This hyper-targeted approach opens new prospects by directing resources toward the most promising segments.

Additionally, display advertising facilitates remarketing efforts, whereby financial institutions can re-engage with users who have shown prior interest in their products or services. Institutions reinforce their brand presence, nurture relationships, and encourage conversions by intelligently tracking user behavior and displaying tailored ads across Google Display Network, YouTube, and apps placements.

Banner ads to reach a wider audience

Banner ads serve as a handy way to widen audience reach. Eye-catching visuals on high-traffic websites and social media platforms allow financial institutions to leave a lasting impression on potential customers. With a well-designed banner ad, banks and lenders can effectively convey unique selling propositions, such as competitive interest rates, tailored wealth management solutions, or hassle-free loan approval processes.

A diverse range of banner ad options – from interactive animations to tasteful static images – helps to create an aesthetically pleasing and captivating advertisement that aligns with the brand identity. Financial institutions may take advantage of increased visibility and brand exposure by placing banner ads on websites frequently visited by the target audience. For instance, displaying real estate loan offers on the popular property listing websites or promoting retirement planning guidance on platforms frequented by senior citizens ensures that your ads are put directly in front of the right eyes.

Targeting to maximize effectiveness

Imagine you’re a leading bank aiming to attract new millennial customers. Display ads can showcase an innovative mobile banking app that offers seamless financial management on the go. Vibrant and engaging banner ads could be placed on popular lifestyle websites and social media platforms frequently visited by millennials. Targeting this specific demographic ensures the message is delivered to those more likely to be interested in your offering.

Now, let’s consider a different scenario. A financial institution specializes in retirement planning services and wants to reach individuals nearing retirement age. Display advertising could present compelling visuals of happy retirees enjoying their golden years, backed by statistics and testimonials highlighting your institution’s retirement planning expertise. Placements on websites and forums focused on retirement planning, investment strategies, and personal finance would guarantee that the right audience sees your ads.

Integrating SEO and SEM Campaigns

Coordinating keyword strategies

Integrating SEO and SEM strategies can yield optimal results for executing successful digital campaigns. One crucial aspect of this integration is coordinating keyword strategies effectively. Keyword research forms the backbone of both SEO and SEM campaigns. By identifying and targeting the right keywords, financial institutions can enhance their online presence, attract relevant traffic, and convert potential customers.

By analyzing the behavior and preferences of potential customers, financial institutions can determine which keywords are most likely to drive qualified traffic. For instance, if a bank specializes in mortgage lending, incorporating keywords such as “low mortgage rates” and “home loan options” would be vital for attracting individuals considering home buying.

Another essential aspect of coordinating keyword strategies is maintaining alignment between SEO and SEM efforts. By integrating keyword strategies across both channels, financial institutions can improve their chances of ranking highly in organic searches and delivering targeted ads to interested users. For example, using the exact high-performing keywords in paid search ad copy and putting efforts into finding the same keyword in organic search results ensures consistency and strengthens credibility.

Furthermore, continuous monitoring and analysis of keyword performance are vital for campaign refinement. Regularly reviewing metrics like click-through rates, conversion rates, and cost per acquisition allows for identifying which keywords generate the most value and adjusting a strategy.

Integrating SEO and SEM Campaigns

Analyzing data to make data-based decisions

Data analysis forms the backbone of any successful digital marketing strategy because gathering relevant data about the target audience, competitors, and industry trends is imperative. Utilizing Google Analytics, we can dig deep into website traffic insights, conversion rates, and user behavior patterns. This data serves as a compass, guiding us toward data-driven decisions and allowing us to fine-tune SEO and PPC campaigns.

Integrating SEO and SEM is a powerful combination that offers a holistic approach to digital marketing. By merging digital strategies, financial businesses gain access to a wealth of valuable data that can be thoroughly analyzed and leveraged to make informed decisions. We can continually optimize processes and adapt to changing market trends by monitoring the performance of both SEO and PPC campaigns.

For instance, if the data shows that a particular keyword is driving significant traffic through a PPC campaign but not organically, we can focus our SEO efforts on improving the ranking for that specific keyword. Similarly, if an SEO campaign generates substantial traffic but does not convert into leads, PPC ads can target this specific audience to push them down the funnel or exclude from campaign.

Through SEO analytics, companies can scrutinize search patterns, customer behavior, and keyword trends, enabling them to understand their target audience better. This information can then shape the direction of both SEO and PPC campaigns to improve effectiveness and generate higher conversion rates.

One significant advantage of combining SEO and PPC campaign data is identifying high-performing keywords more efficiently. SEO analytics reveal which keywords drive organic traffic and convert leads, allowing finance businesses to refine their content and capitalize on those specific terms. On the other hand, PPC campaigns provide immediate feedback on ads’ performance using selected keywords. Integrating SEO and PPC campaigns fosters a cohesive and synchronized marketing approach. Together, they create a dynamic synergy that maximizes brand exposure and reach.

Integrating SEO and SEM Campaigns

Estimate optimal campaigns budget to reach expected profitability

Estimating an optimal budget for your SEO and PPC campaigns requires a comprehensive analysis of various factors. Firstly, we need to define a goal clearly. It may be a specific number of generated leads, increased brand awareness, target market share, or expected traffic volume. Each objective necessitates a different approach and budget allocation.

Market research and keyword volume help to identify ideal customers‘ specific keywords, search terms, and online behavior. This insight allows us to tailor SEO and PPC strategies, optimizing budget allocation to reach the intended audience effectively.

Another vital aspect is analyzing competitors’ presence in SERPs. By benchmarking against their strategies, we can gauge the investment required to stay competitive and establish a solid online presence. Some 3rd party tools may be helpful to do that. We can estimate competitors’ budgets using Google Keyword Planner, Semrush, or SpyFu software and prepare to challenge their impression share.

Furthermore, the seasonal fluctuations that occur within the financial industry. Certain periods, such as tax season or major economic events, may witness increased search volumes and competition. Allocating a higher budget during these peak times may maximize visibility and capitalize on potential customers’ heightened interest. Gaining proper insights and a data-driven approach may help align the budgets across both channels and acheive desired profitability, reach, or market share.

Integrating SEO and SEM Campaigns

PPC campaigns budgeting

Similar to SEO, the competitiveness of the Filipino financial industry demands a budget capable of outshining your counterparts in the paid search arena. Thorough keyword research, understanding audience behavior, and crafting ad campaigns will ensure that every Peso invested in PPC brings a substantial return on investment.

Furthermore, it allows for analyzing campaign profitability, advertisers’ market share, and business goals. The budget allocated should align with these aspirations, letting us dominate the SERPs, capture the target audience’s attention, and drive conversions. Appropriate budget allocation involves several key considerations, including bidding strategies, ad targeting, and the potential cost per click (CPC) for specific keywords within the industry. While ensuring an optimal budget, financial institutions should embrace flexibility, continuously monitoring and adjusting their allocation based on shifting market dynamics and campaign performance indicators.

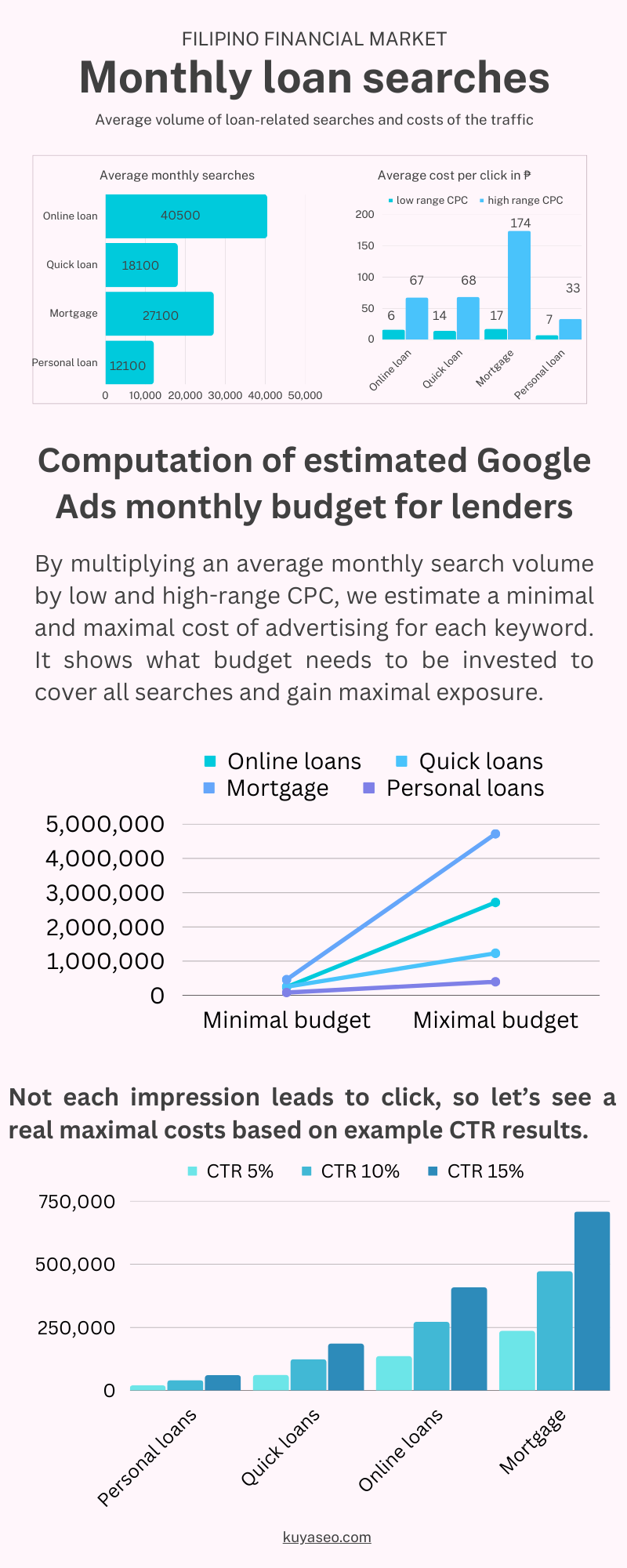

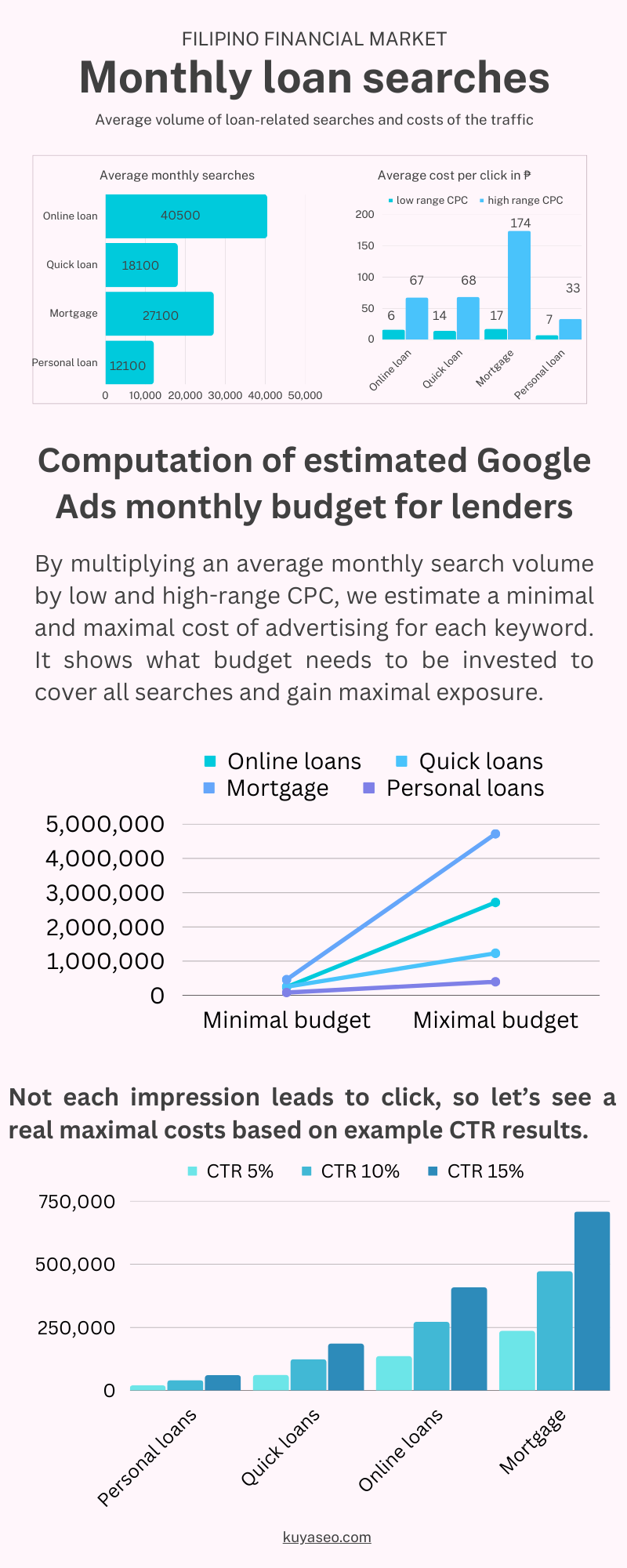

The provided analysis of keyword examples shows the market’s depth and forecasts the necessary budgeting constraints to compete in the Filipino market. Our analysis of 4 widely searched keywords displays a budget that should be considered to gain maximum exposure to specific niches. Of course, these examples only mirror some of the demand potential of certain financial products. Let’s take a look at the keywords and forecasted monthly budgets with CTR 5%, 10% and 15%

personal loan: 19965 – 39930 – 59895 Peso/month

quick loans: 61540 – 123080 – 184620 Peso/month

online loans: 135675 – 271350 – 407025 Peso/month

mortgage: 235770 – 471540 – 707310 Peso/month

Conclusion

A summary of search engine marketing for financial institutions

In conclusion, search engine marketing has become indispensable for Filipino financial industry companies such as banks, lenders, and insurance companies. We have explored key points to consider when implementing search engine marketing strategies, including understanding the audience, conducting keyword research, implementing efficient ad copies and landing pages, and monitoring performance metrics.

Additionally, we emphasized the importance of staying up-to-date with industry trends and best practices to ensure long-term success. By embracing search engine marketing techniques, financial companies position themselves at the forefront of millions of potential customers. Successful campaigns are built on solid foundations: a deep understanding of target audiences and their behaviors and continuous adaptation based on comprehensive analytics. So take advantage of all the opportunities that search engine marketing offers today and get a free quote.